Mastering Forex Trading Options: A Comprehensive Guide

Forex trading options present a unique opportunity for traders to leverage their investments in the dynamic foreign exchange market. Understanding the mechanics of these instruments can empower you to make informed decisions and enhance your trading strategies. Moreover, you can find valuable resources and forex trading options Trading Brokers in Qatar to optimize your trading experience. This article provides a detailed overview of forex trading options, including their benefits, strategies, and the risks associated with them.

What Are Forex Trading Options?

Forex trading options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell a currency pair at a predetermined price (known as the strike price) on or before a specified expiration date. This flexibility is a significant advantage over traditional spot trading, where you are required to execute a transaction.

There are two primary types of forex options: call options and put options. A call option gives the buyer the right to purchase a currency pair, while a put option allows the buyer to sell a currency pair. Understanding these fundamental concepts is crucial for leveraging options effectively in forex trading.

Benefits of Trading Options in Forex

Forex trading options offer several advantages, including:

- Flexibility: Traders can choose to buy or sell options based on their predictions without the obligation to do so.

- Limited Risk: The maximum loss is limited to the premium paid for the option, providing a cap on potential losses.

- Leverage: Options can provide significant leverage, allowing traders to control larger positions with smaller amounts of capital.

- Income Generation: Selling options can generate premium income, creating a potential revenue stream.

Understanding Option Pricing

The price of a forex option, known as the premium, is influenced by several factors, including the strike price, expiration date, current market conditions, and the volatility of the underlying currency pair. The Black-Scholes model is one of the most widely used methods for pricing options, as it provides insight into how these factors affect the option’s market value.

Trading Strategies with Forex Options

There are various strategies that traders can employ when dealing with forex options. Some of the most popular strategies include:

- Buying Calls and Puts: Traders can buy call options if they believe the currency pair will rise and put options if they expect a decline.

- Spreading: This strategy involves buying and selling options on the same currency pair simultaneously. It aims to profit from the difference in premiums.

- Straddles and Strangles: These strategies involve buying both calls and puts to profit from significant market movements, regardless of direction.

- Covered Calls: Investors can sell call options against their existing currency positions to generate income while maintaining some upside potential.

Risks Involved in Forex Trading Options

While trading options can offer several benefits, it is essential to recognize the inherent risks involved:

- Expiration Risk: If the market does not behave as anticipated, options can expire worthless, resulting in a total loss of the premium.

- Liquidity Risk: Not all currency options will have liquid markets, leading to difficulty in executing trades at favorable prices.

- Complexity: Options trading requires a solid understanding of various strategies and how market factors affect pricing.

Choosing the Right Broker for Forex Options Trading

Selecting the right broker is crucial for success in forex options trading. Some essential factors to consider include:

- Regulation: Ensure that the broker is regulated by a reputable authority, which provides some level of security for your funds.

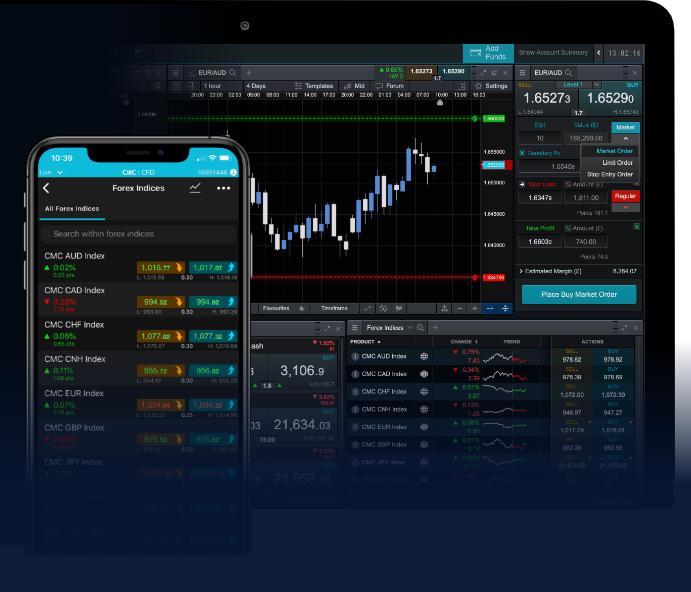

- Trading Platform: The platform should be user-friendly, providing necessary tools for analysis and execution of trades.

- Fees and Costs: Understand the commission structure, spreads, and any additional fees associated with trading options.

- Customer Support: Reliable customer support is vital for addressing any issues that may arise during trading.

Conclusion

Forex trading options are a versatile and powerful tool for traders looking to navigate the foreign exchange market. By understanding the mechanics, benefits, and risks involved, as well as employing effective strategies, traders can enhance their trading performance. Remember, the key to successful trading lies in continuous education, disciplined strategy implementation, and choosing the right broker to facilitate your trading journey.

By investing time in learning and applying the principles of forex options trading, you can empower yourself to seize opportunities and manage risks, ultimately paving the way to achieving your financial goals in the currency markets.