Is Forex Trading Halal or Haram? Understanding the Islamic Perspective

The world of finance is vast and complex, and one of the most debated topics within the Muslim community revolves around the permissibility of forex trading. Forex trading, or foreign exchange trading, involves the buying and selling of currencies on the foreign exchange market. With the rise of online trading platforms, many Muslims are eager to know if engaging in forex trading aligns with Islamic principles. In this article, we will explore the different aspects of forex trading, looking into the Shariah compliance and the main factors determining whether it is halal or haram. For insights and third-party services related to trading, consider visiting forex trading halal or haram https://trading-terminal.com/.

Understanding Halal and Haram

To navigate the complexities of forex trading within an Islamic framework, it’s essential to define the terms “halal” (permissible) and “haram” (forbidden). Halal refers to actions and matters that are lawful in Islam, while haram pertains to those that contravene Islamic law. The principles guiding these classifications generally stem from the Qur’an and Hadith, and they can vary based on interpretation among different scholars.

The Basics of Forex Trading

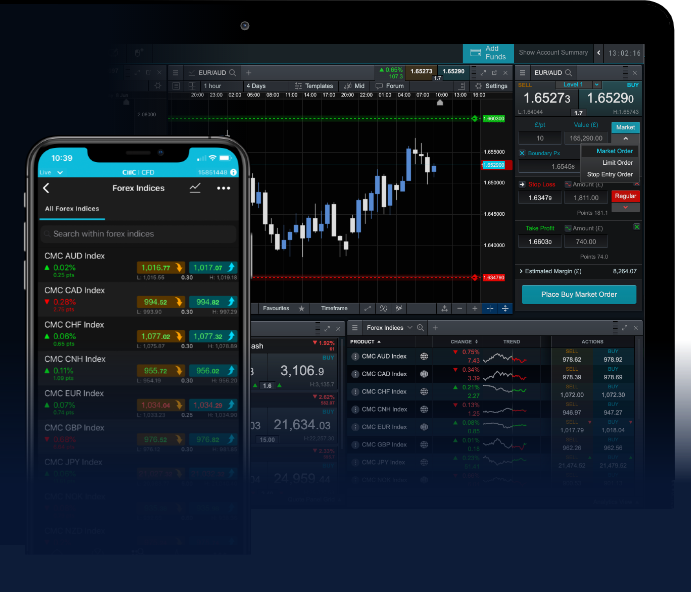

Forex trading involves speculating on the price movements of currency pairs, where currencies are bought and sold in exchange for one another. Traders aim to profit from fluctuations in exchange rates, utilizing various strategies and tools available in the forex market. Due to high volatility and liquidity, the forex market operates 24 hours a day, attracting traders from around the globe.

Key Aspects of Forex Trading and Islamic Law

There are several important factors to consider when evaluating whether forex trading is halal or haram. Primarily, we will focus on the following elements:

1. Riba (Usury)

One of the greatest concerns regarding forex trading is the issue of riba (interest or usury), which is strictly prohibited in Islam. Many forex brokers offer leveraged trading accounts that may involve interest on borrowed capital. If a trader holds a position overnight, they might incur a swap fee, often viewed as riba. However, some brokers offer Islamic accounts that operate without swap fees, catering specifically to Muslim traders.

2. Gharar (Uncertainty)

Gharar refers to excessive uncertainty or ambiguity in financial transactions. Forex trading, which often involves speculation on the future movements of currency pairs, can sometimes be associated with gharar. Scholars debate whether the predominant nature of trading in the forex market constitutes excessive uncertainty. A key to ensuring that forex trading is halal is to approach it with clear strategies based on research and analysis rather than gambling-like speculation.

3. Intention and Ethical Conduct

The intention behind entering into forex trading plays a vital role in determining its permissibility. If the trader approaches forex trading with the intent to make a livelihood, support family, or invest wisely, it may be viewed favorably. Additionally, ethical conduct in trading—such as honesty, fairness, and transparency—aligns with Islamic principles.

4. Timeframes and Holding Periods

Some Islamic scholars point out that the duration for which one holds a currency can influence the trading’s permissibility. Long-term investing in forex markets, where the intent is to hold until a profitable exchange rate is attained, is generally viewed differently than day trading or scalping, which might involve more speculation.

Scholarly Opinions

The views of Islamic scholars vary widely regarding forex trading. Some scholars deem it haram due to the presence of riba and gharar, while others maintain that with the right conditions, it can be considered halal. Numerous Islamic finance organizations have also endorsed certain practices in forex trading, provided they do not involve prohibited elements.

Choosing an Islamic Forex Broker

For Muslim traders interested in forex, finding the right broker is paramount. Many brokers now offer Islamic accounts that are designed to comply with Shariah law. These accounts avoid interest fees (swap rates) and offer terms conducive to halal trading. When seeking an Islamic broker, consider the following:

- Check for the availability of Islamic accounts.

- Confirm their transparency regarding fees and trading practices.

- Research reviews and ensure that the broker is regulated and reputable.

Conclusion

In conclusion, the question of whether forex trading is halal or haram does not yield a straightforward answer. It depends on multiple factors such as the trading mechanism, fees involved, intention, and adherence to ethical practices. Ultimately, individual traders should seek knowledge, consult reliable scholars, and consider their personal circumstances when deciding to engage in forex trading. The key is to ensure that all trading practices align with Islamic principles to achieve both financial success and spiritual compliance.